As is customary when Nintendo’s annual financial results are presented, shareholders have been asking the company’s president, Shuntaro Furukawa, a series of questions about various aspects of the company’s business. Well, David Gibson, co-founder of Astris Advisory Japan, has translated (into English) and shared some of the most salient questions and answers from the Big N’s earnings call.

Here they are:

Q: Why are you forecasting a drop in units?

A: Last year there was Animal Crossing and telecommuting, so we expect a year-on-year decline in the first half. We do not assume any telework benefits. The forecast of 25.5 million hardware units is based on the parts that are known and therefore can be produced. If more can be produced, it will be produced, as the momentum is strong.Q: What are the trends of active Switch users like?

A: When Animal Crossing launched, it spiked and then dropped, but the holiday season drove active users to a record level, dropped a bit in the new year, but with the Monster Hunter Rise titles, etc., activity has returned to high levels.Q: What assumptions do you make about the outlook?

A: Animal Crossing drove growth last year, which continued into Q4. Volume of non-Animal Crossing first-generation titles increased in the fourth quarter. First-time Animal Crossing users tend to buy other first party titles. Super Mario 3D World did very well in Q4, along with other titles. For users who bought Switch in the holiday season, the next game title is purchased digitally. The digital purchase option has become the norm.Q: In what areas is the increased R&D being spent?

A: We’re still in the middle of the Switch cycle, so software and outsourcing costs are increasing for Switch, which is the main driver. The cost per title is also increasing and you need a certain level of scale. We are also investing in online. Although we are halfway through the Switch cycle, there is a need to invest in the next platform, where hardware and software integration will continue.Q: How is demand in the EU/USA?

A: In general, there are no major changes by territory: demand continues to be strong. The hardest temporary impact in the EU is the shortage of product on the shelves due to COVID-related transportation/logistics issues.Q: Where is Switch penetration highest?

A: Around 20% of Switch purchases are the second device in the home, and this is expected to continue to grow. We are also seeing good growth in Asia, which has a lot of room for growth. The EU, given its scale, has room for growth.Q: The situation in China?

A: Mario Tennis event for Chinese New Year, Switch volumes in Q4 were up year-on-year, and they’re still working to increase sales.

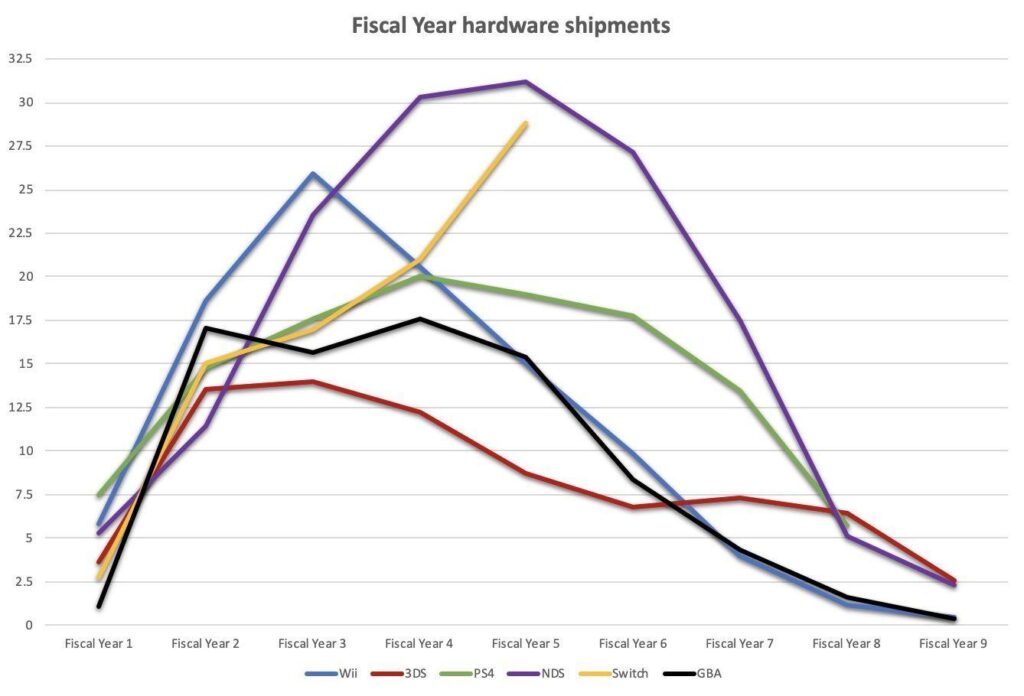

These are certainly interesting details that are sure to catch the attention of the Japanese company’s fans. Finally, we leave you with this graph, shared by Necro Felipe (a journalist from Switch Brazil), where you can see the annual unit sales of consoles according to their fiscal years. What is striking is that while most consoles’ sales drop from the third fiscal year onwards, Nintendo Switch continues to soar even in its fifth fiscal year.

Here it is: